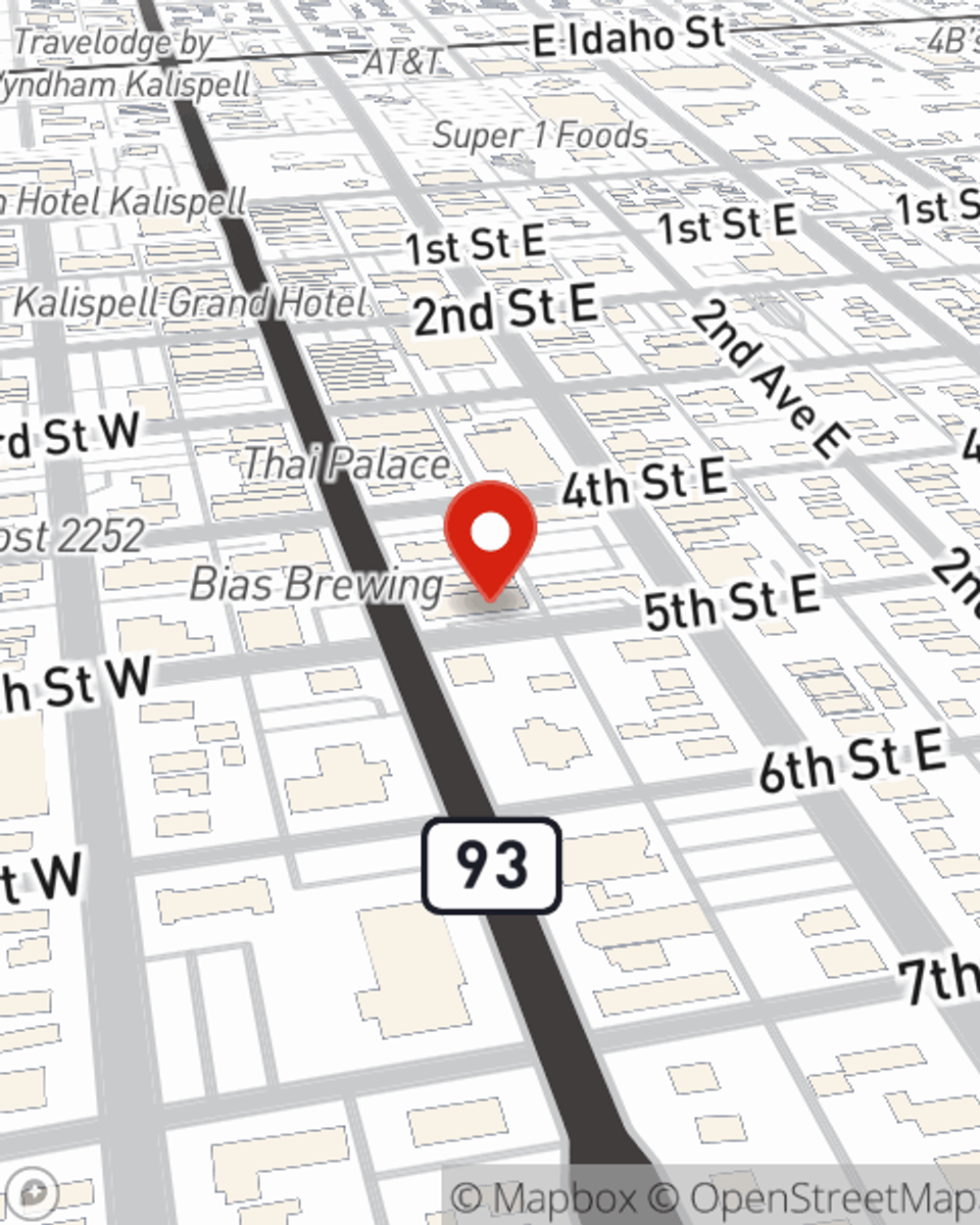

Insurance in and around Kalispell

A variety of coverage options to help meet your needs

Protect what matters most

Would you like to create a personalized quote?

It’s All About You

You’ve worked hard to get to where you are. Let State Farm® insurance help protect you, your loved ones and the life you’ve built. From safe driving rewards, bundling options and discounts, you can create a solution that’s right for you. For 100 years, we’ve made it our mission to restore lives, help rebuild neighborhoods, invest in towns, and support education and safety initiatives right where we live and work. It's what being a good neighbor in the Kalispell area is all about. Contact Matt Downing for a Personalized Price Plan.

A variety of coverage options to help meet your needs

Protect what matters most

Insurance Products To Meet Your Ever Changing Needs

Want to know why State Farm is the largest insurer of automobiles and homes in the U.S.? Great insurance coverage options, competitive prices, easy claims and excellent service might have a lot to do with it. Or maybe you're looking to help secure your family's financial future. Let us help you ease that burden. The unmatched strength of State Farm Life Insurance, a wide range of products and Personalized Price Plans; it's a great value and smart choice.

Simple Insights®

Backyard structures and home insurance

Backyard structures and home insurance

Do you have detached structures or a swimming pool on your property? Learn how they're covered by home insurance.

Matt Downing

State Farm® Insurance AgentSimple Insights®

Backyard structures and home insurance

Backyard structures and home insurance

Do you have detached structures or a swimming pool on your property? Learn how they're covered by home insurance.